In this couple of days, Singapore-listed US Office REIT Manulife put out a few announcements.

The first one is the following:

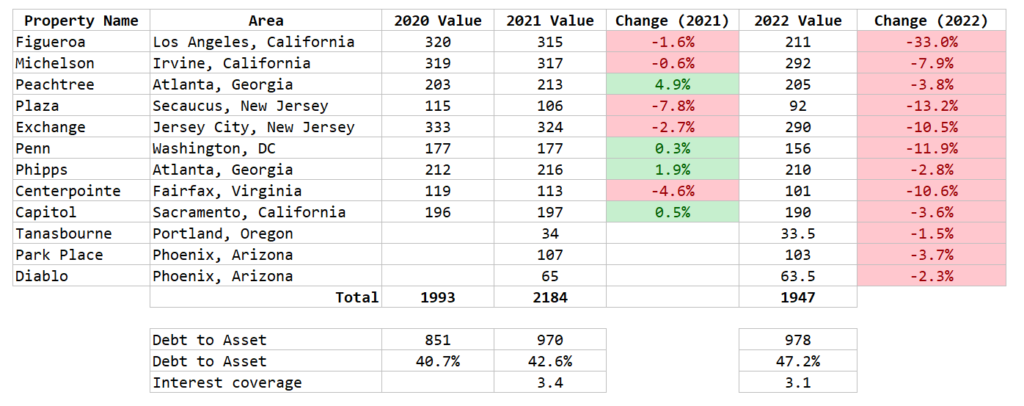

After they received the latest revaluation of their properties a couple of days ago, they felt it is important to be transparent about the information that will be material to the company.

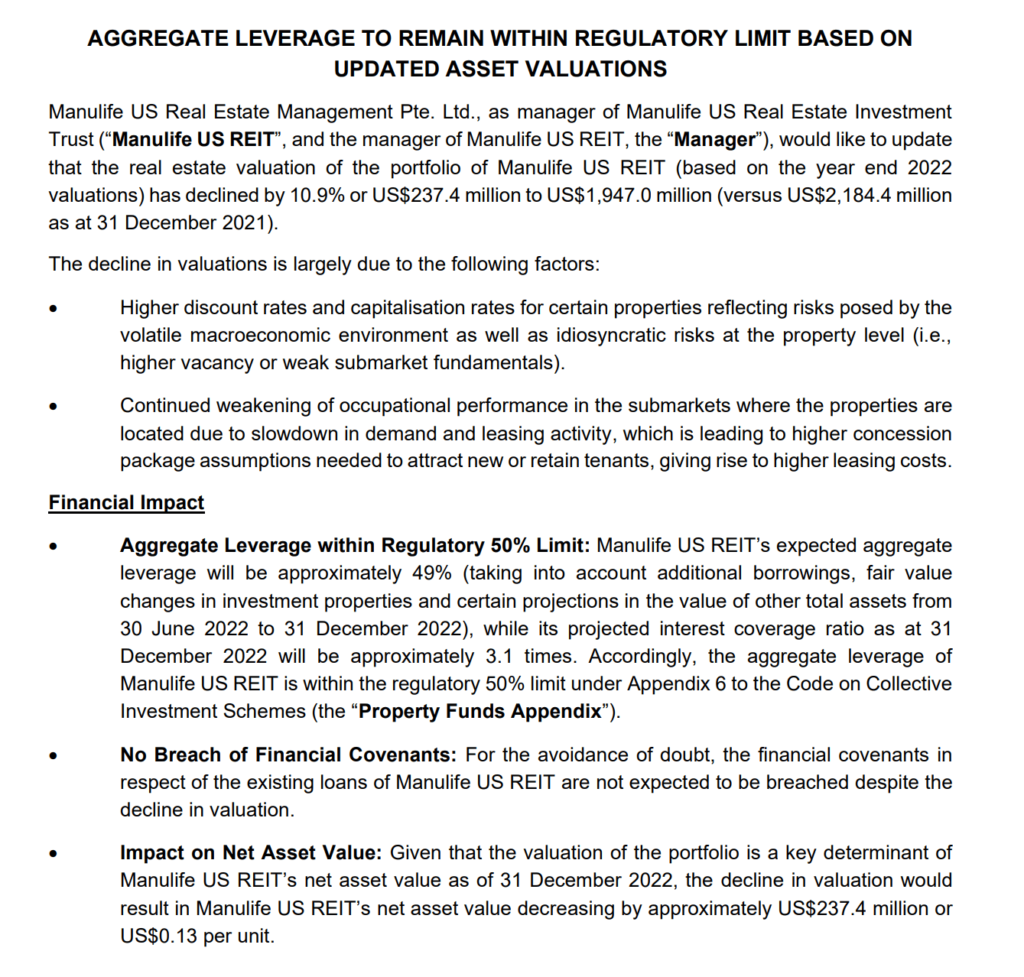

With the new valuation, their aggregate leverage will approach a level closer to the regulatory limit of 50%. The aggregate leverage is approximately 49%, and the projected interest coverage is closer to 3.1 times.

There would not be a breach of financial covenants. A breach of financial covenants may require the borrower to do something or pay a higher interest cost.

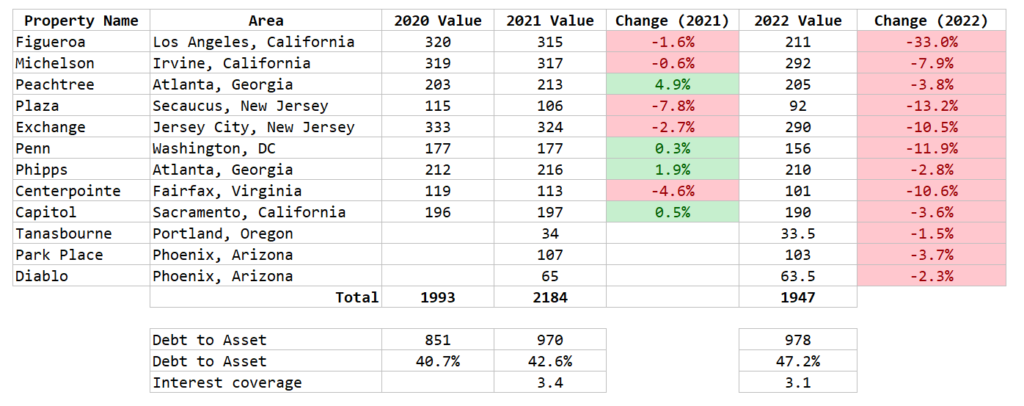

Revaluation of the portfolio of properties from 2020 to 2021 and 2022

The table above shows the portfolio of properties under the REIT and the valuation changes over the last two years. The change from 2020 to 2021 was relatively minimal, but in some areas, such as Washington, New Jersey and California, there was a significant downward revaluation.

From what I understand, it was due to a mixture of discount rates and projected stable rental income. The valuer is assessing the rent each property can fetch over the lifetime. Figueroa was particularly hard hit because an existing tenant decided to renew roughly half of its existing leases.

Based on their half-year 2022 results, I worked out a debt-to-asset of 47%, slightly less than the 49% they discussed. We can see that the significant gearing increase was due to a slight increase in debt but also a reduction in asset value.

I would expect Prime US and Keppel Pacific Oak to report downward revaluation but to different degrees. Not all properties are located in the same areas, and even if they are located in the same area, different properties might be valued differently.

On 2nd November last year, Manulife announced that they had appointed Citigroup as their financial adviser to conduct a strategic review. They will think about what levers they can pull to improve the situation.

From what I understand, the commercial property market also froze when the interest rate environment rose. These properties are usually purchased with some form of leverage. When the rates are rising at this pace, there is uncertainty about whether this is the suitable period to purchase the property and what kind of financing an investor can get.

The general market borrowing cost accessible has risen to 6%.

Manulife could look at divesting some properties requiring more asset enhancements and use the proceeds to pare down gearing. Any rights issues at this price will be very dilutive. Most likely, this is the last course of action.

Whichever way, I do think the absolute net income will have to come down.

Currently, Manulife US REIT pays a half-yearly dividend per unit of $0.0261, bringing the annualized dividend yield to 17.4%.

While attractive, this dividend yield is not sustainable. There is likely to be further pain ahead if recession really bites, and tenants decide to scale back their cost in a big way. We are already seeing strong indications from companies to reduce staff and with less staff and hybrid work, less space will be needed.

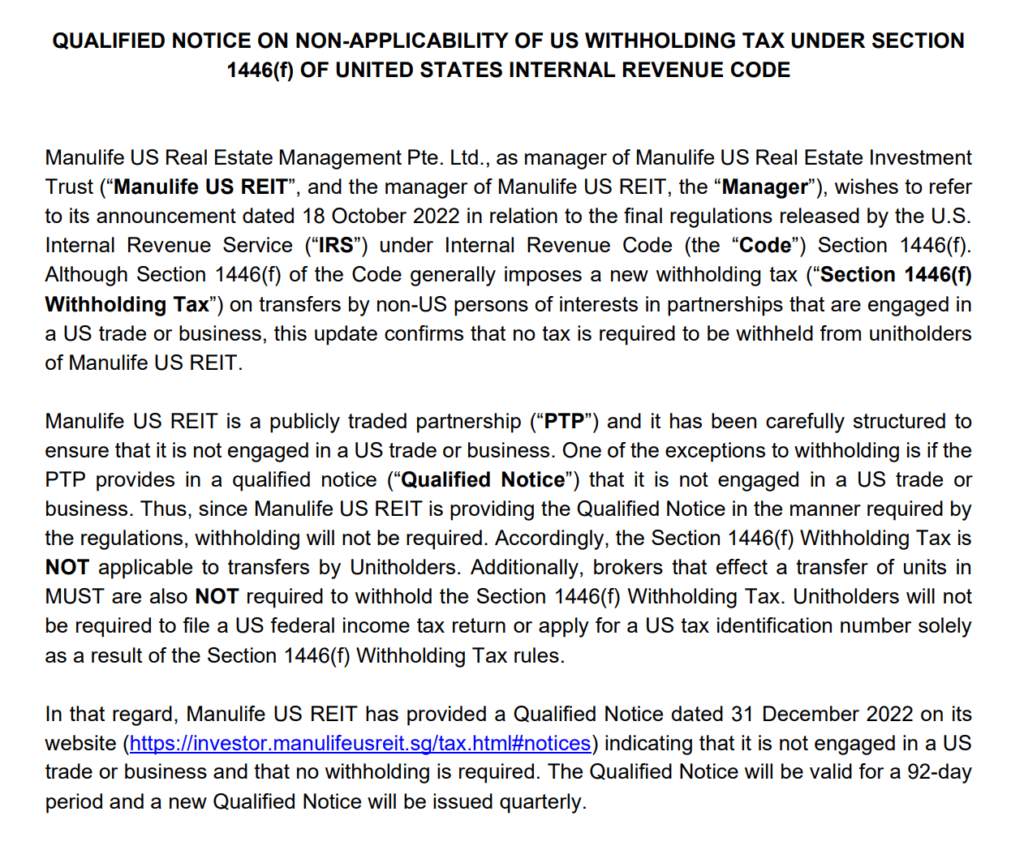

The second announcement was a qualified notice that Manulife US REIT will not be subjected to additional withholding tax:

If you are a stock investor, you may have received a few announcements recently regarding an additional 10% withholding tax on capital gains or dividends for US companies that qualify as publicly traded partnerships ("PTP").

This has unsettled investors and traders.

As a REIT that is carefully structured so that they do not need to pay the usual 30% US withholding tax on dividends, Manulife and its peers faced additional uncertainty. This notice sought to ease the fear that an additional 10% needs to be withheld.

I think seeing the symmetry in many of these recent tax adjustments is essential.

Most of the clarifications since the significant Tax Cut and Jobs Act change in 2017 and subsequent changes are more to prevent US companies operating in the US from escaping taxes by using some overseas structures.

If you think from this perspective, then everything will make sense. Even in this notice, the REIT is trying to prove that they do not engage in a US trade or business. So they are trying to prevent money from flowing out, not investments from coming in.

Many of the firms this recent change targets are firms structuring themselves as partnerships. Likely, they are tightening up against mainly the limited partners' interest in hedge funds and private equity.

Unless that general stand has changed, I don't think there should be a worry there.

If you want to trade these stocks I mentioned, you can open an account with Interactive Brokers. Interactive Brokers is the leading low-cost and efficient broker I use and trust to invest & trade my holdings in Singapore, the United States, London Stock Exchange and Hong Kong Stock Exchange. They allow you to trade stocks, ETFs, options, futures, forex, bonds and funds worldwide from a single integrated account.

You can read more about my thoughts about Interactive Brokers in this Interactive Brokers Deep Dive Series, starting with how to create & fund your Interactive Brokers account easily.