Last year the two top trades were Product and LNG tankers. Both trades doubled invested capital. Last week Oaktree sold half of their position in Hafnia that depressed Hafnia share price by 10%. Our family office bought in the SPO and bought in the market on that day so we are fully positioned in Hafnia up to our stock/sector investment limit.

The main reason for buying back is the forthcoming sanctions on EU purchases of Russian diesel that come into effect on 5th February.

Hafnia is top pick by Pareto, Fearnley and DNB securities.

- Pareto has a price target 80 NOK, 54% upside from current share price

- Fearnley has a price target of 73 NOK, 40% upside from current share price

- DNB has a price target of 73 NOK, 40% upside from current share price

Sanctions favour Hafnia

From 5 February, 2023 the EU entities are not allowed to buy products from Russia. This will result in Russia selling their diesel outside of EU and EU exporting diesel from the middle east and further. The average distance for EU products will increase materially. That should push the rates higher.

Pareto research dated 17/1/23 stated on this:

70% of the Russian diesel trade originates from the Baltic, the remainder from the Black Sea. Data from Facts Global suggest that the tonne-miles on that latter 30% will "only double", while the Baltic flows will rise by more than 4x

The shipping rates increases may come with some time lag - before the sanctions Russians were trying to sell to the EU as much as possible - that resulted in Europe´s being well supplied with diesel.

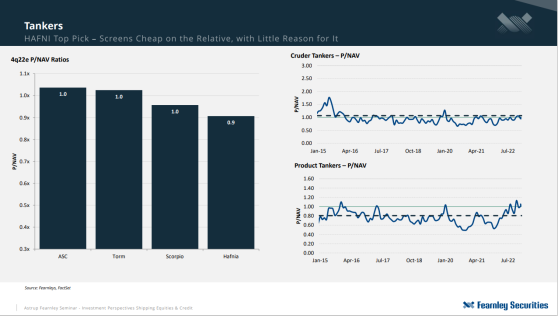

Hafnia continues to screan cheap relative to peers

Hafnia is trading at 10% discount to peers.

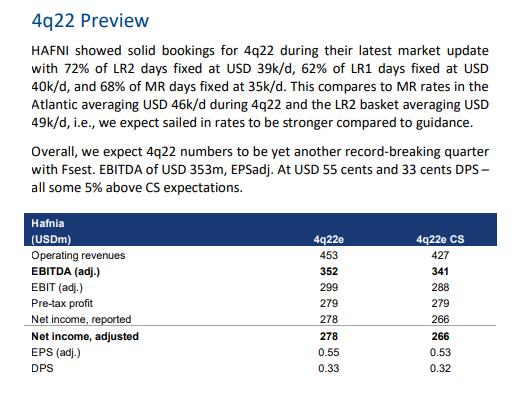

Hafnia should report the best quarter ever with highest dividends

The best ever quarter expected with the company making more than 10% of its market capitalization in the quarter and expected to pay out 3 NOK per share, which implies 23% annualized dividend yield.

Fearnley Securities research on Hafnia dated 4/1/23:

Pareto note from yesterday morning:

HAFNI NO, TORM DC, STNG US - Tankers - MR rates in Asia posting further 5 - 10% gains this morning, very positive to see. FGE (oil macro) is out saying they have it from two different sources that Russian diesel exports could be higher in February than in January, and that based on this they would expect strong freight rate momentum from the second half of the month. Our case is unchanged, we expect rates to be higher in 2023 than in 2022 (when HAFNI generates NOK 16 of EPS) - with recent weakness being due to EU inventory builds in Q4, lower USGoM exports (due to refinery outages) and lower Chinese long-haul exports. A few months from now we will see large volumes of Russian diesel to the MEG and Asia - and similar volumes then back to the EU.

I believe product tankers will be strong trade for the year, as diesel is much harder to replace than crude. Not sure we will double the money here, but substantial return is expected.

Disclosure:

The goal of the blog is to provide investment ideas for further research. I/we have a beneficial position in the shares discussed above either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. The article does not represent investment advice. Please do your own research before making any investment action.

No comments:

Post a Comment